Protests have erupted among Central Java residents concerning a perceived increase in the Motor Vehicle Tax (PKB) for 2026. However, the Regional Secretary for the Central Java Provincial Government, Sumarno, has refuted claims of a tax hike for the current year, asserting that the tax value payable by the public in 2025 remains identical to that in 2026.

During a press conference on Friday, June 24, Sumarno emphasized, “We assert that the motor vehicle tax position in Central Java for 2026, compared to 2025, shows no increase.” He further elaborated on the specific surcharges, known as ‘opsen’, which have been consistently applied. From 2025 to 2026, the PKB surcharge in Central Java is set at 16.6 percent of the principal PKB value, while the Motor Vehicle Transfer of Ownership Tax (BBNKB) surcharge stands at 32 percent of its principal value.

The perception of a tax increase largely stems from the fact that Central Java residents received a significant relaxation or discount of 13.94 percent on their taxes between January and March 2025. This meant citizens did not have to pay the full amount during that period. Consequently, the absence of such a substantial discount this year created an impression of rising costs.

Addressing these concerns, Sumarno revealed a proactive measure: “The Governor has requested us to review the PKB surcharge, and we will implement a 5 percent relaxation. Details regarding its application will be communicated as soon as possible.” Despite this forthcoming discount, he acknowledged that this year’s planned relaxation is smaller than the previous year’s. “Yes, the 2025 tax relaxation was 13.94 percent; this year, it’s only a planned 5 percent,” he clarified.

The policy concerning this tax bonus or “pemutihan” (amnesty) is currently under review, with careful consideration given to public purchasing power and broader socio-economic conditions. The provincial government is also prepared to tighten its belt on the 2026 Regional Budget (APBD) to accommodate the provision of this bonus. Sumarno reiterated, “For its implementation, we will inform as soon as possible.”

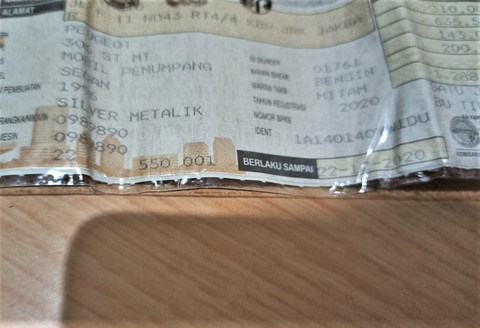

In addition to these measures, the Central Java Provincial Government continues to implement an exemption for the Motor Vehicle Transfer of Ownership Tax II (BBNKB II) for used vehicles. However, owners are still required to pay other essential fees, including the Motor Vehicle Tax (PKB), Non-Tax State Revenue (PNBP) for Vehicle Registration Certificates (STNK), License Plate Numbers (TNKB), and Vehicle Ownership Books (BPKB), as well as the Road Accident Fund Contribution (SWDKLLJ).

This sentiment was echoed by Muhammad Masrofi, Head of the Central Java Provincial Regional Revenue Management Agency (Bapenda). He explained that the underlying tax increase has, in fact, been in effect since January 2025, in accordance with Law Number 1 Year 2022 concerning Financial Relations between the Central and Regional Governments. Masrofi concluded, “This year, the discount has not yet been implemented, making it seem like an increase, even though the actual rise has been in place since 2025. Now, responding to public aspirations, the Governor intends to provide a 5 percent discount.”

Summary

Central Java residents have protested over a perceived increase in the Motor Vehicle Tax (PKB) for 2026. However, Central Java Provincial Government Regional Secretary Sumarno clarified that the PKB value for 2025 and 2026 remains unchanged, denying any tax hike. This perception of an increase largely stems from a significant 13.94 percent tax relaxation provided to citizens from January to March 2025, which is not being applied at the same level this year.

The underlying tax adjustments have, in fact, been in effect since January 2025, in accordance with Law Number 1 Year 2022. To address public concerns, the Governor has requested a review of the PKB surcharge and plans to implement a 5 percent relaxation, although this is smaller than the previous year’s discount. The provincial government is also reviewing its “pemutihan” (amnesty) policy and will adjust the 2026 Regional Budget to accommodate this new bonus.